Transformation of banking services for business clients - how can the Bank and the Сlient become partners?

Oksana Kutsokon, Director of Business Banking at Raiffeisen Bank Aval, spoke about new trends in servicing business clients and new package offers of the Bank for small and micro businesses.

How, in your opinion, has the business and its requirements for banking services changed in recent years?

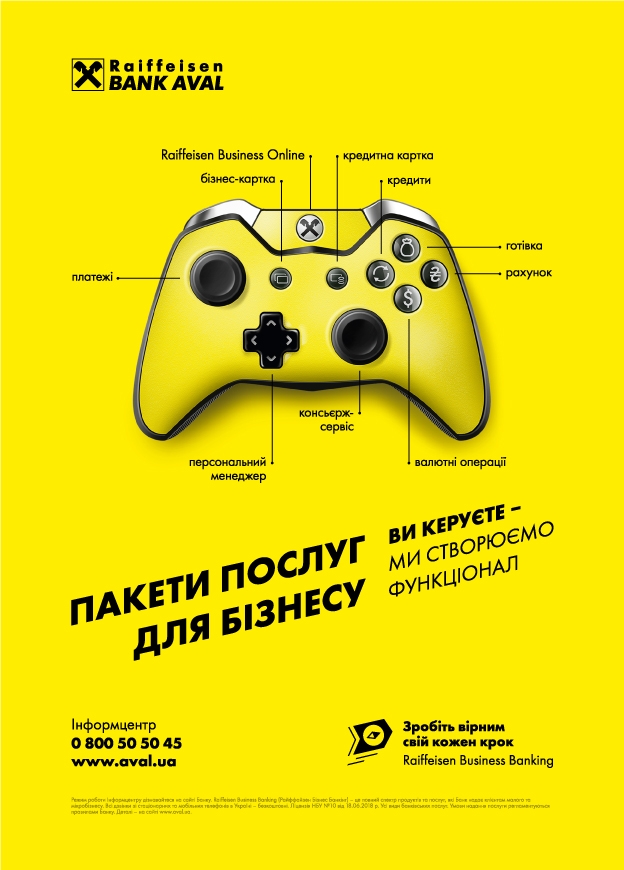

We live in a very dynamic and difficult time, as the banking sector and the business are facing enormous challenges. Small and micro business in Ukraine is rapidly developing, studying, modernizing, and is increasingly looking for additional opportunities and services that would help to conduct a business easier, more economical, more efficient. Today, business expects from the Banks not only the opportunity to conduct financial transactions, but is increasingly interested in products and services that help to conduct and develop the business. It is very important for us to meet the expectations of our customers, therefore Raiffeisen Bank Aval, as one of the leaders in customer service for small and micro businesses, has updated its service model for such customers and offers a new line of packages in which each client will find not only the optimal set for his business services and products, but also additional services and benefits.

What are the benefits of the new service packages for SMEs?

Today, the offer of package services to clients of small and micro businesses from Raiffeisen Bank Aval is essentially unique, as we offer not just a package of services, but also offer all our customers to become part of the modern business community, use a range of services and services sufficient to satisfy their needs each business client, use the chat bot and business concierge service, receive additional products and services at a reduced cost, use discounts from partners.

The new line of packages for clients of small and micro businesses from Raiffeisen Bank Aval includes 4 packages with a different set of products and services. Each client will find the best option for himself, depending on his needs and the level of planned cooperation with the Bank - from doing business with a single debit card account to premium services by a personal manager who will solve all business client issues related to banking products and services.

If we talk about package offers, which are the simplest of them, and which, on the contrary, have unique characteristics?

The simplest package at Raiffeisen Bank Aval is Business Start. This is a package that is sufficient to conduct business with a payment card. It is most suitable for entrepreneurs who start their own business, use simple banking services and rarely come to the Bank. If necessary, the client can also get a credit card. The price of this package is only 100 UAH. per month. And when carrying out 10 or more non-cash transactions on the account, the cost of maintenance will be only 50 UAH. This is the discount approach that I mentioned above. As part of this package, there is access to info support in the bank’s chat bot and to the free application from the partner of the YouControl bank partner (an application for monitoring the status of business partners), and also has the ability to insure against an accident (available insurance amount from 150 thousand UAH).

If your business is actively developing, growing and needs a larger list of banking products and services, then the package for basic needs - “Business Classic” is relevant for you. In addition to the card account, a current account in hryvnia is also available here. Available operations with cash desk, online bank, unsecured lending. As well as in the entire line of packages, there is access to the information chat bot and YouControl application.

But it is possible to insure against an accident (affordable insurance amount from 150 thousand UAH) at special prices below standard offers. The cost of service under this package is 150 UAH. per month. And new customers can use it for free for the whole 3 months.

If a company needs to carry out foreign exchange payments, foreign exchange transactions, and there is a large number of cash transactions, as well as the need for loans for a large amount, then I recommend using the Business Comfort package. It includes opening a current account in national and foreign currencies, a debit card for business, the possibility of obtaining unsecured and secured loans, an online bank, an information chat bot and a business concierge service unique in the market, in which there is the opportunity to receive monthly professional advice and services prepaid by the bank.

Tariffs for operations within the framework of the Business Comfort package are already much more attractive, which will give the client the opportunity to save daily. There is also the possibility of insurance at special prices with an insured amount of already 300 thousand UAH. For new customers, there is also the opportunity to try all the benefits of this package for 3 months for free.

Raiffeisen Bank Aval has been offering new packages since May 2019 and the Business Comfort package has appeared in the nomination “Clients Choice”. The cost of service under this package is only 350 UAH. per month. But if the client has balances of at least 50 thousand UAH on his accounts. per month, in spite of the best rates and the prepaid expensive concierge service, the client receives a discount and pays as for a regular package - only 200 hryvnias per month.

I would like to note a unique in many respects premium business package - “Business Elite +”. It is designed for reputable companies and customers who need premium service with the highest priority. Today, only Raiffeisen Bank Aval offers business customers a premium package and premium services, which are already traditional for wealthy individuals. Tariffs for cash transactions are cheaper than basic ones, online banking, all external payments are also free, which significantly saves the client the cost of doing business. Sum insured - already 600 thousand, insurance prices - special.

In addition to an unsecured loan, a business gets the opportunity of a pre-calculated total credit limit and access to quick financing, the ability to conduct currency transactions, a personal premium manager, access to the Business Navigation service, as well as the opportunity to use the unique Concierge service business and even a premium business VISA Platinum card.

Also, without restrictions, you can use the bank's information chat bot and access to the already mentioned YouControl service. The cost of service under this package is 950 UAH. per month, but the cost of a set of services and discounts in this package exceeds the price by 5 times. Moreover, the discount condition also exists here. With average monthly balances on the current account from 150 thousand UAH. (or a loan worth more than 300 thousand UAH), the business client will be able to pay for the premium package as for an ordinary one - only 200 UAH. per month.

And what exactly is the uniqueness of this package?

The client receives a premium service area in the bank’s digital offices in large cities of Ukraine and to a mobile personal manager in smaller cities. With a VISA Platinum premium business card, a client with the Business Elite + package gets free access to the fast track and lounge zone at airports. Please note that according to our new strategy, the higher the class of the package, the more attractive the tariffs, less interest for cash withdrawals, the cost of payment in Internet banking.

What is the peculiarity of the concierge service business that you spoke about?

For customers with the highest class of service, we presented a unique service “business concierge service” - a completely new approach for the market, when premium individual service with a private client is transferred to the format of business relations. For example, a company is represented by a director / owner or accountant. With a concierge service, such a company representative receives simply the best assistant for solving personal issues: organizing trips, booking tickets, check-in for flights, choosing goods and buying, ordering a table in a restaurant, finding tours and places to relax, and much more that you need find, decide, buy and deliver. And such individual secretary-concierge services have already been paid by the bank and included in the packages "Business Elite +" and "Business Comfort". In addition to organizing trips and purchases, your personal concierge will help you receive monthly free legal advice from the best lawyers, free tax advice, free translation of a contract or contract up to 3 pages, graphic or web designer services, courier delivery 2 times a month in big cities. He will also be the first to receive information about special products of the bank or partner discounts. And all this in a chat messenger without unnecessary calls.

I want to note that we continue to develop interesting new proposals for our business community.

Our new approach is simple - be with us and get the maximum benefits from banking services. Our goal is to become the main bank for existing customers, and for new customers to offer high-quality, stable and modern services of the highest class. Join now!