Change in the rates of EH and ERUs

The Law of Ukraine "On the State Budget of Ukraine for 2020" along with the main indicators approved the new minimum wage for 2020 and the cost of living, which, in particular, will affect the size of the UN, ERUs, tax social benefits, etc. Let us dwell on this.

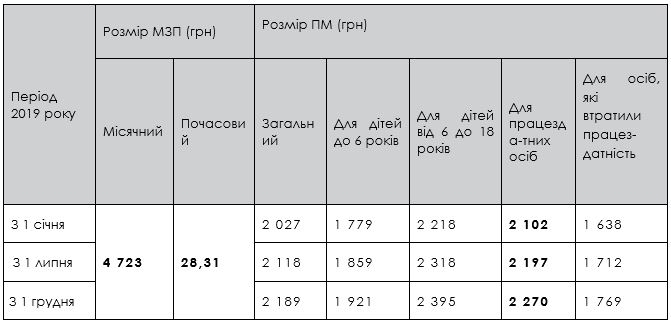

Starting January 1, 2020, the minimum wage (minimum wage) and living wage (PM) increase. Further growth of the plant wages is not planned, but the PM will grow during the year. We give their sizes below in the table.

Entrepreneurs should take into account that many of the indicators that have to be calculated to pay taxes depend on the size of the minimum wage or salary set for able-bodied people. Some of them are tied to the MPZ or PM established on January 1 of the reporting year.

Single tax

So, the size of the rates of single tax payers (single tax) of the first and second groups depends on the size of the ML and MP. Recall that the EH rates for the FLP, who elected the first or second group, are approved by the decisions of local councils depending on the types of activity. For the first group they cannot be more than 10% of the size of the PM established for able-bodied people as of January 1 of the reporting year, and during the year they do not change with the growth of the PM, and for the second group - no more than 20% of the monthly wage established for January 1 of the reporting year (Article 293 of the TCU).

The maximum rate of EH is:

- for the first group - 210.20 UAH;

- for the second group - 944.60 UAH.

It should be noted that an increase in the minimum wage and income will not affect the rate of EH for FLP of the third group. Since the EH rates for the third group are set at a fixed rate of 5% or 3% + VAT.

The growth of the minimum wage and salary will also not affect the size of the EH rate, which is applied in case of violation of the working conditions on the simplified taxation system. She is still 15%. This rate applies to:

- the amount of excess of the allowed income for the selected group;

- income of the unity of the first and second groups, received from a type of activity that is not indicated in the register of single names or prohibited for this group;

- income derived from the use of non-monetary forms of payments;

- Income received from the type of activity prohibited for the unity of the unity.

Single social contribution

The provisions of the Law of Ukraine of 08.07.2010 No. 2464-VI “On the collection and accounting of a single contribution to compulsory state insurance” determine the order in which FLPs must pay ERUs.

Doctors can independently determine the amount of income from which they will pay ERUs. Moreover, the amount of such income does not depend on the amount of income from entrepreneurial activity. It cannot be lower than the size of the minimum wage and more than the maximum amount of income that accrues ERUs (15 minimum wage). In 2020, the minimum wage is 4,723 UAH, the maximum income is 70,845 UAH (4723 UAH x 15).

Therefore, the minimum ERU for the month is 1039.06 UAH (4723 UAH x 22%), and the maximum - 15 585.90 UAH (70 845 UAH x 22%).

General system managers charge ERUs on the amount of entrepreneurial income subject to personal income tax. At the same time, the amount of ERUs, like that of the lenders, cannot be less than the size of the monthly minimum insurance premium, even if the monthly income is less than the minimum wage or is absent altogether. For general system managers, the rule of law is generally applied: ERUs are charged on income not exceeding the maximum income, even if the average monthly business income exceeds this amount.

As in 2019, entrepreneurs (regardless of the tax system) who relate to persons with disabilities are exempted from paying ERUs for themselves, receive an old-age pension or have reached the age established by Art. 26 of the Law of Ukraine of 09.07.2003 No. 1058-IV “On Compulsory State Pension Insurance”, and receive a pension or social assistance in accordance with the Law.

Natalia Shcherbak, consultant for the newspaper "Private Entrepreneur"